Service Provider of

VAT registration number is one of the crucial parts of every transaction. It is intended to specify the tax processing of certain transactions and allow the financial authorities to monitor the application of the new regulation. This pretty much explains why VAT registration number of the company and that of the customer must be specified on invoices for tax-exempt deliveries and other goods and services within the European Union. The VAT registration number is thus a part of the control procedure that has replaced the former border controls (EC sales list).

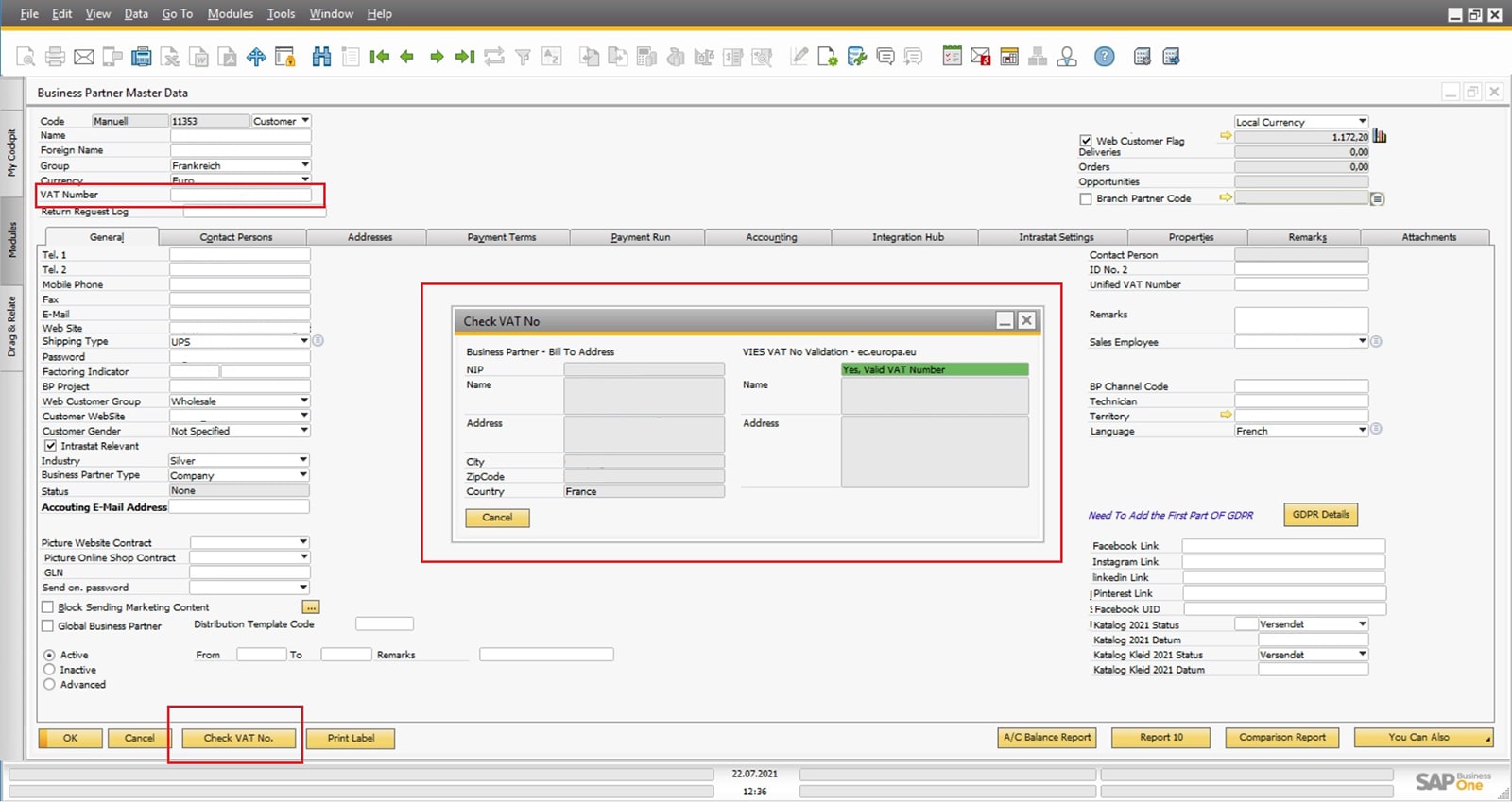

As a PartnerEdge® member, we can leverage the advantages of SAP’s European Union VAT Checking functionality, which means we can right away verify the validity of customer's VAT number from the official website of VIES in just one click. It helps streamlining business process in just one click.